Giving

Create Your Own Legacy

Over the next 25 years, individuals and families in Genesee County will leave close to $20 billion to their children, grandchildren, and relatives through their estates. If everyone – including you – considers a planned gift to benefit the community, we can change the future of Genesee County.

Planned Giving Vehicles

Including a charitable bequest in your will is a simple way to make a lasting gift to your community. When you make this gift through the Community Foundation of Greater Flint, we establish a special fund that benefits the community forever and becomes your personal legacy of giving.

How it Works

You include the Community Foundation in your will as a bequest. We can help you or your attorney with the recommended language. Download the Sample Testamentary Language (.PDF).

Upon your death, we establish a special fund in your name, in the name of your family, or in honor of any person or organization you choose. Your gift is placed into an endowment that is invested over time. Earnings from the fund are used to make grants addressing community needs or carried out per your wishes.

Your gift – and all future earnings from your gift – is a permanent source of community capital, helping to do good work forever.

Giving through a Charitable Gift Annuity allows you to arrange a generous gift to your community while providing yourself a new income source you can count on for the rest of your life.

How it Works

You make a gift to the Community Foundation of Greater Flint – you can give cash, appreciated stocks, real estate, or other assets. We set up a contract with you that combines immediate annuity payments with a deferred charitable gift. You receive a stream of income that is fixed, regardless of market conditions. You also receive an immediate tax deduction for the charitable portion of your gift.

We handle all the administrative details—issuing annuity payments to you during your lifetime. Upon your death, we direct your gift to an existing fund or establish a fund in your name.

Giving through a Charitable Remainder Trust allows you to receive income for the rest of your life, knowing that whatever remains will benefit your community.

How it Works

You transfer cash, appreciated stocks, real estate, or other assets into a trust. You receive an immediate charitable tax deduction for the charitable portion of your trust. The trust pays you, or a beneficiary, regular income payments. Upon the beneficiary’s death or after a defined period of years, the remaining assets in the trust transfer to the Community Foundation of Greater Flint.

We establish a fund in your name, in the name of your family or business, or in honor of any person or organization you choose. We handle all the administrative details after the fund is established, issuing grant awards to charities in the name of the fund.

A Charitable Lead Trust helps you build a charitable fund with the Community Foundation of Greater Flint during the trust’s term. When the trust terminates, the remaining assets are transferred to you or your heirs, often with significant transfer-tax savings.

How it Works

You transfer cash, appreciated stocks, real estate, or other assets into an irrevocable charitable trust. We establish a fund in your name, in the name of your family or business, or in honor of any person or organization you choose. Your Charitable Lead Trust pays the Community Foundation an annual amount to build a charitable fund. You designate the trust to exist for a specified number of years or until your death. You also designate your family or anyone you choose as the final beneficiary of your trust.

If you choose, you can stay involved in the good works your gift makes possible – working with our professional program staff to support the causes and agencies you care about most. We handle all the administrative details, awarding grants to charities in the name of the fund you establish.

Life insurance policies can be used as charitable gifts. If you name the Community Foundation of Greater Flint as the owner and beneficiary of an existing or new life insurance policy, you receive an immediate tax deduction, which usually approximates the cash surrender value of the policy. All premium payments made by you thereafter will be deductible as a charitable contribution.

Gifts from IRAs and 401ks can be an impactful gift to charity. Unlike Roth assets which are generally tax-free to a recipient, non-Roth retirement accounts can sometimes be taxed twice before they get to a beneficiary. You can gift these assets to the Community Foundation of Greater Flint.

How it Works

Name the Community Foundation of Greater Flint as a 100% beneficiary of an account and start a fund in your family’s name. Or, indicate that the Community Foundation is a beneficiary of a certain percentage of the account and the remainder can go to individual beneficiaries. Another option is to name the Community Foundation as a contingent beneficiary so that if a primary beneficiary doesn’t survive you, it works toward your charitable goals.

The tax-free charitable IRA is an option if you are age 70 ½. If married, each spouse can transfer up to $100,000 from his or her IRA annually, tax-free. Your gift can be placed into a charitable fund in your name, the name of your family, or in honor of any person or organization you choose. Grants addressing the community need you've identified will be made forever.

Unless someone like you cares a whole awful lot, nothing is going to get better. It’s not.”

- Dr. Seuss

Let’s Give for Education

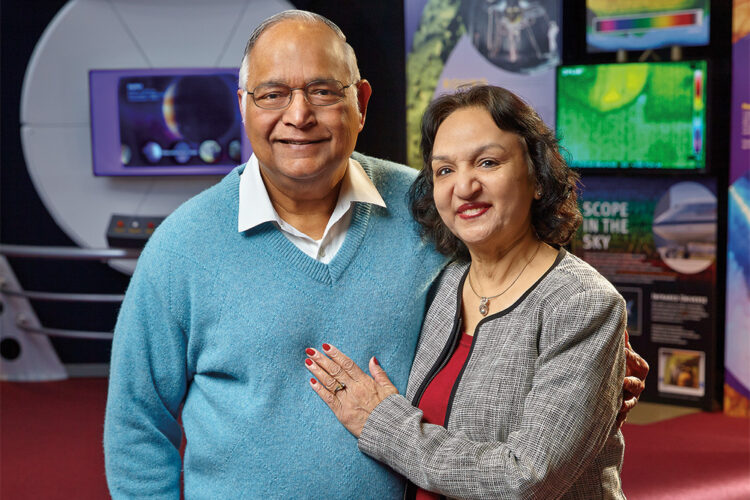

Sitting around their kitchen table in a peaceful neighborhood in Grand Blanc, Kamal and Shashi Gupta reflect on the philanthropic values they share together as a couple, and as a family.